Ethereum Treasury Giant SharpLink Resumes ETH Purchases As Holdings Top $3.5 Billion

content, reviewed by leading industry experts and seasoned editors. Ad Disclosure

Ethereum (ETH) treasury firm SharpLink Gaming has resumed purchasing ETH. The firm made its first ETH purchase since August 2025, acquiring another 19,271 ETH at an average purchase price of $3,892 per ETH.

Minneapolis-based SharpLink Gaming today announced that it had increased its total ETH holdings by 19,271 ETH. The firm’s total ETH holdings now stand at 859,853 ETH, valued at almost $3.5 billion.

The company disclosed that it raised $76.5 million in gross proceeds last week, excluding placement agent fees and other related expenses. These proceeds were used to finance the latest ETH purchase. Commenting, Joseph Chalom, co-founder of SharpLink Gaming, said:

Our top priority remains creating value for shareholders through disciplined execution and a relentless focus on accretive ETH accumulation. The capital raise completed last week was executed at a premium to NAV. Shortly thereafter, we took advantage of attractive market conditions to acquire ETH at prices lower than when we raised the capital. This sequence was immediately accretive to shareholders and showcases the precision of our strategy.

The Nasdaq-listed firm also shared that its total ETH staking rewards had increased to 5,671. To recall, SharpLink Gaming had started its ETH-focused corporate treasury strategy in June 2025.

The company also reported a 100% increase in Etheruem Concentration. The metric surged to 4.0, up 100% since June 2025.

For the uninitiated, Ethereum concentration measures how much ether SharpLink holds per 1,000 assumed diluted shares, offering insight into the company’s crypto exposure relative to its total potential equity base. It’s calculated by dividing total ETH holdings (including LsETH) by all issued and potentially issuable shares, without using the treasury stock method or accounting for vesting or conversion restrictions.

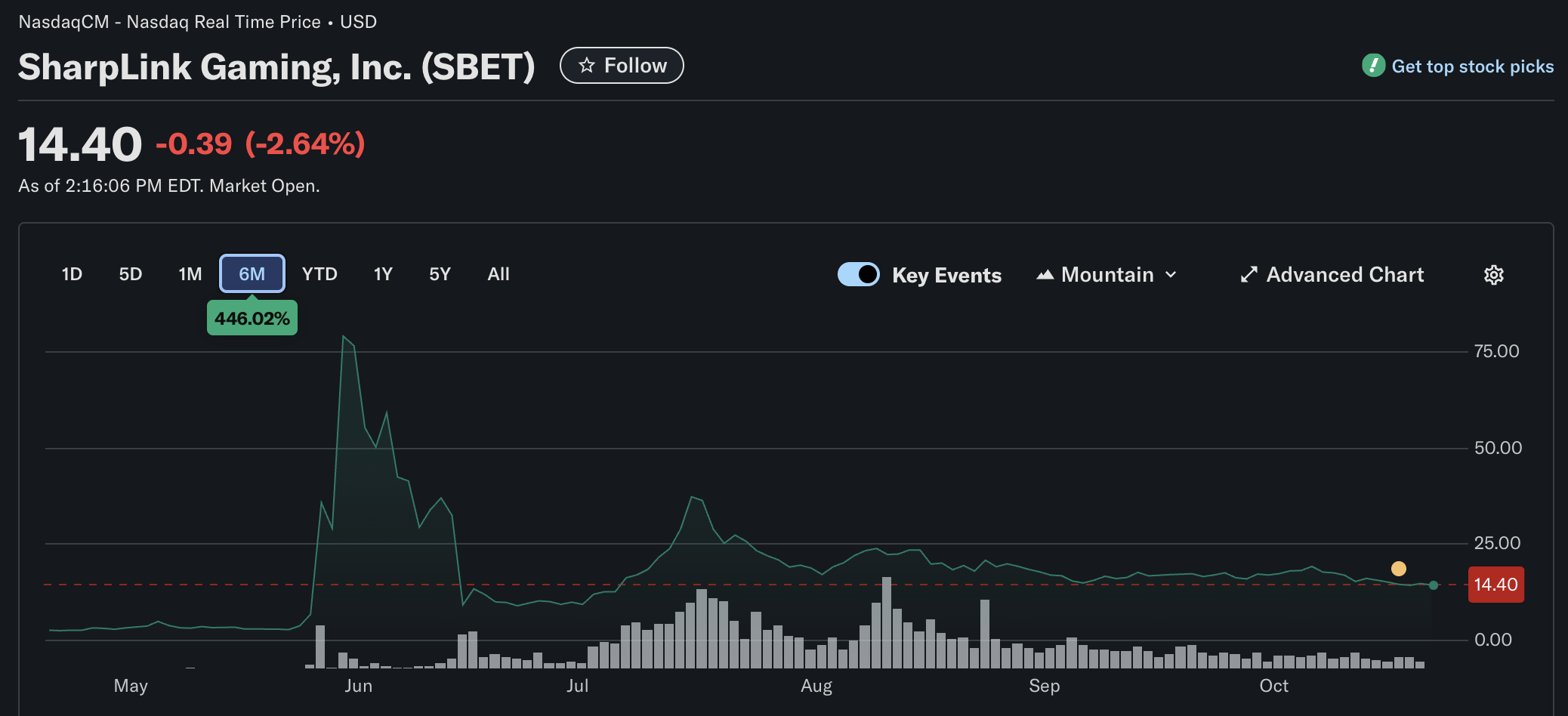

Following today’s announcement, SharpLink Gaming’s stock SBET is down 2.64%, trading at $14.40 at the time of writing. The stock is up more than 440% over the past six months.

ETH Taking The Limelight From Other Crypto

2025 has seen an unprecedented growth in the number of firms adopting a crypto-focused corporate treasury strategy, not just limited to leading digital assets like Bitcoin (BTC), or ETH.

For instance, NYSE-listed CleanCore Solutions recently announced that its Dogecoin (DOGE) treasury had topped 710 million DOGE. The firm has an aim of adding 1 billion DOGE to its balance sheet.

That said, the rate of Ethereum adoption has surpassed all other digital assets – including BTC – throughout the year. Recently, Ethereum whale BitMine purchased another 203,800 ETH, effectively owning 2.7% of Ethereum’s circulating supply. At press time, ETH trades at $3,988, up 0.8% in the past 24 hours.

Featured image from Unsplash.com, charts from Yahoo! Finance and from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Sign Up for Our Newsletter!

For updates and exclusive offers enter your email.

Ash is a seasoned freelance editor and writer with extensive experience in the blockchain and cryptocurrency industry. Over the course of his career, he has contributed to major publications, playing a key role in shaping informative, timely content related to decentralized finance (DeFi), cryptocurrency trends, and blockchain innovation. His ability to break down complex topics has allowed both seasoned professionals and newcomers to the industry to benefit from his work. Beyond these specific roles, Ash’s writing expertise spans a wide array of content, including news updates, long-form analysis, and thought leadership pieces. He has helped multiple platforms maintain high editorial standards, ensuring that articles not only inform but also engage readers through clarity and in-depth research. His work reflects a deep understanding of the rapidly evolving blockchain ecosystem, making him a valuable contributor in a field where staying current is essential. In addition to his writing work, Ash has developed a strong skill set in managing content teams. He has led diverse groups of writers and researchers, overseeing the editorial process from topic selection, approval, editing, to final publication. His leadership ensured that content production was timely, accurate, and aligned with the strategic goals of the platforms he worked with. This has not only strengthened his expertise in content strategy but also honed his project management and team coordination skills. Ash’s ability to combine technical expertise with editorial oversight is further bolstered by his knowledge of blockchain analysis tools such as Etherscan, Dune Analytics, and Santiment. These tools have provided him with the data necessary to create well-researched, insightful articles that offer deeper market perspectives. Whether it’s tracking the movement of digital assets or analyzing blockchain transactions, his analytical approach adds value to the content he produces, ensuring readers receive accurate and actionable information. In the realm of content creation, Ash is not limited to just cryptocurrency markets. He has demonstrated versatility in covering other emerging technologies, market trends, and digital transformation across various industries. His in-depth research, coupled with a sharp editorial eye, has made him a sought-after professional in the freelance writing community. From developing editorial calendars to managing content delivery schedules, he has honed a meticulous approach to project management that ensures timely, high-quality work delivery. Throughout his freelance career, Ash has consistently focused on improving audience engagement through well-researched, insightful, and relevant content. His ability to adapt to the evolving needs of clients, whether it’s enhancing the visibility of digital platforms or producing thought-provoking pieces for a wide range of audiences, sets him apart as a dynamic force in the field of digital content creation. His contributions have helped to shape a well-rounded portfolio that showcases his versatility, technical expertise, and dedication to elevating the standards of journalism in blockchain and related sectors.